Amidst the rising uncertainties in the global economy, the Philippines emerges as one of the darlings of economic growth. In this article, we will take a closer look at the remarkable aspects of the Philippine economy and see how it has successfully navigated pandemic woes, ultimately rising to become one of Asia’s fastest-growing economies and an attractive foreign investment destination.

Economic Resilience and Promising Outlook

In the context of the COVID-19 pandemic, the Philippines was one of the most adversely affected countries in numerous socioeconomic aspects, experiencing nearly a complete halt of the country’s economic prospects, a decline in the standard of living, a dramatic increase in the cost of living, a vulnerable labor force, and a net outflow of foreign investments.

In light of this, let us examine these very same macroeconomic aspects to see how Manila has made noteworthy strides to not only remain resilient but also signal a promising future outlook:

1. Economic Growth

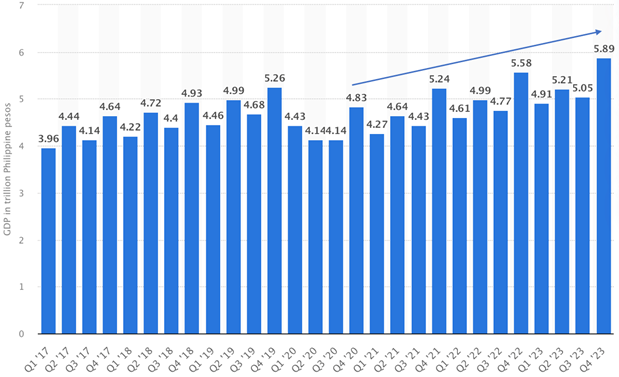

Philippine GDP Value (2017 – 2023)

Source: Statista

First, examining the country’s GDP, we observe consistent year-on-year (YoY) economic growth, culminating in an all-time high (ATH) GDP value of P5.26 trillion ($93.9 billion) in Q4 2019. This was before the major nationwide lockdown in 2020, which hampered the country’s positive economic trajectory. Nevertheless, the Philippines demonstrated its economic strength by not merely recovering but also surpassing the 2019 ATH within two years after the 2020 lockdown. Moreover, the Philippines reached a new economic milestone of P5.89 trillion ($105.2 billion) in Q4 2023, and yearly GDP stood at P21 trillion (around $400 billion) in 2023.

Moving forward, the Philippine government projects that the country’s GDP will grow by at least 6.5% to 7.0% in 2024, representing one of Asia’s fastest rates of economic growth. Additionally, S&P Global forecasts that the Philippine economy will be worth $1 trillion by 2033, more than doubling the country’s 2023 GDP value in the next ten years. Undoubtedly, Manila’s GDP prospect remains bright.

2. Standard of Living

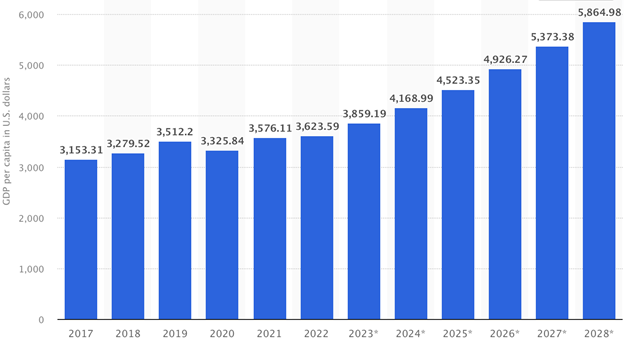

Philippine GDP Per Capita (2017 – 2028)

Source: Statista

Second, when it comes to the country’s living standard, we can look at its GDP per capita as a primary indicator. As such, similar to the country’s GDP, after the GDP per capita fell by 5.31% resulting from the nationwide lockdown in 2020, we can observe a dramatic increase, hitting $3,800 in 2023. Furthermore, the International Monetary Fund (IMF) projects that the country’s GDP per capita will surpass the $4,000 mark for the first time this year and is expected to reach $5,800 by 2028, representing a remarkable 8.85% average YoY growth in the next five years.

This trend points to a much stronger purchasing and investing power on average for Filipinos, which translates to a relatively much higher standard of living in the country. This also aligns with the World Bank’s projection of the country hitting the upper-middle income status as early as next year, 2025.

3. Inflation

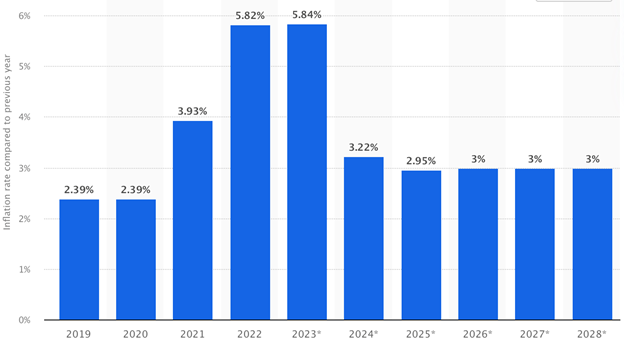

Annual Inflation Rate (2019 – 2028)

Source: Statista

Third, looking at the country’s yearly inflation data, we can see how dramatic the increase was after 2020. This was due to inflationary fiscal and monetary policies that the Philippine government and central bank employed to cushion the country’s economy. On the fiscal side, the country — like many economies worldwide — distributed cash stimulus packages, resulting in a drastic increase in government spending. Meanwhile, the Bangko Sentral ng Pilipinas (BSP), the Philippine Central Bank, cut interest rates to lower the cost of borrowing and encourage spending. Hence, the country experienced a sustained high inflation rate from 2021 to 2023.

Nevertheless, due to the responsible tightening policy implemented by the BSP to curb inflation — which received commendations from international organizations for being prompt and decisive — inflation is expected to substantially decline to normal levels starting in 2024. Moving forward, the IMF projects it to hover within the BSP’s inflation target of 2 to 4%.

4. Labor Force

Unemployment, Underemployment, and Labor Force Participation Data (2019-2023)

| Year | Labor Force Participation Rate | Underemployment Rate | Unemployed Rate |

| 2019 | 61.3% | 13.8% | 5.1% |

| 2020 | 59.5% | 16.2% | 10.3% |

| 2021 | 63.3% | 15.9% | 7.8% |

| 2022 | 66.4% | 12.6% | 4.3% |

| 2023 | 66.6% | 11.9% | 3.1% |

Source: Philippine Statistics Authority

Fourth, examining the country’s labor force, which represents one of its major competitive advantages compared to regional peers and other emerging economies, we can identify some noteworthy trends. Notably, the Philippines boasts one of the world’s highest labor force participation rates (which is a country’s percentage of the employed working-age population). Although this rate declined by 1.8% in 2020, it has quickly rebounded, reaching a new high of 66.6%. This indicates that two out of three working-age Filipinos currently participate in the labor market.

Second, the country’s underemployment rate, which climbed in 2020, has significantly declined to 11.9% in 2023, translating to 88.1% of the total workforce better utilizing their skills and time for economic productivity. Lastly, and perhaps most importantly, the unemployment rate, which doubled in 2020 due to massive layoffs nationwide, has dropped by almost 70% to now only 3.1%. Thus, roughly 96.9% of those who want to work are gainfully employed, demonstrating an exceptional recovery of the country’s labor force.

Ultimately, these favorable labor force developments fuel the country’s growth story moving forward and serve as a testament to the country’s economic recovery.

5. Foreign Investments

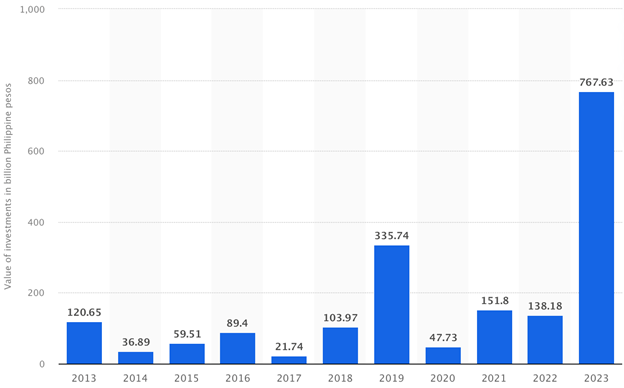

Approved Total Foreign Investments (2013 – 2023)

Source: Statista

Lastly, we can see that the abovementioned positive economic developments are further supported by increased confidence from foreign investors, as represented by the total approved foreign investments in the country. Prior to 2020, the largest investment commitment made was P335.74 billion ($6.1 billion) in 2019. However, due to the pandemic, these figures took a nosedive in the following year, 2020.

Nevertheless, due in part to the government’s efforts to reach out to more investors outside the country, foreign investments rebounded the following year and, incredibly, set a newly recorded ATH total foreign investment worth P767.63 billion ($13.9 billion) in 2023, which is 2.3x higher than pre-pandemic. Overall, these renewed investment pledges speak volumes of the country’s attractive investment environment and bright economic prospects.

Conclusion

Considering all these factors, we can see how the Philippines demonstrated commendable resilience in the face of major socioeconomic challenges brought by the pandemic and global economic turmoil. Furthermore, the country has successfully reignited its growth trajectory, becoming one of the fastest-growing economies in Asia and a prime destination for foreign investors.