In the focal point of Southeast Asia, the Philippines emerges as a beacon of growth and potential, especially within its hospitality sector. With its rich cultural heritage, breathtaking natural landscapes, and steadily growing influx of visitors, the Philippines presents a myriad of possibilities. Furthermore, the Philippine hotel industry is a testament to the country’s rapidly expanding economic landscape, offering lucrative investment opportunities for local and foreign investors. In this article, we will delve into the attractive features, exciting prospects, and trends of Manila’s hospitality industry.

The Attractive Prospect of Hospitality in the Philippines

At the macro level, the Philippines enjoys a remarkable average year-on-year (YoY) economic growth of 6-7% and overtook both Vietnam and Malaysia in 2023 to become Southeast Asia’s fastest-growing economy. With the government’s supportive fiscal policies and multi-year infrastructure development, the hospitality sector plays a meaningful role in this outstanding economic development by successfully positioning the country as a premier tourist destination and investment hub.

With these said, let us take a look at some remarkable developments and trends in the hospitality sector in the Philippines:

1. Tourist Arrivals

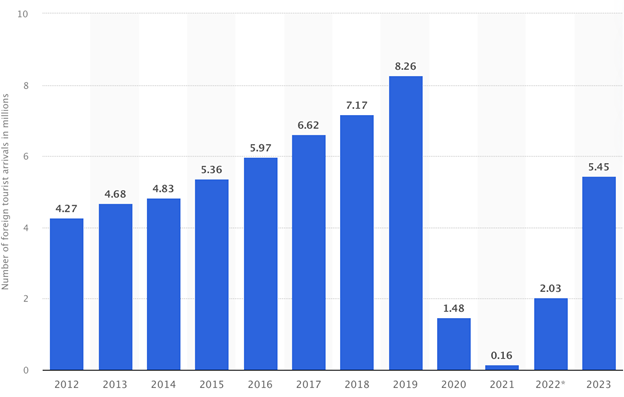

Total Number of International Tourist Arrivals to the Philippines from (2012 – 2023)

Source: Statista

First, examining tourist arrivals in the country, we observe a consistent increase prior to the COVID-19 pandemic, peaking at 8.26 million visitors in 2019. In the five years leading up to this peak (2014 to 2019), tourist arrivals grew by an average of 11.38% year-on-year (YoY), marking exceptional growth by all standards. Unfortunately, the pandemic led to a dramatic reduction in tourist arrivals, falling by 82.08% in 2020 and 89.19% in 2021, respectively.

Nevertheless, following the country’s partial reopening to foreign visitors in 2022 and full reopening in 2023, tourist arrivals surged 11.69 times in 2022 and increased by 168% in 2023. This rebound demonstrates an attractive opportunity to invest in the hotel industry, as visitor numbers are expected to increase rapidly from this year onward, potentially matching and eventually exceeding the 2019 figures.

2. Hotels Market Revenue

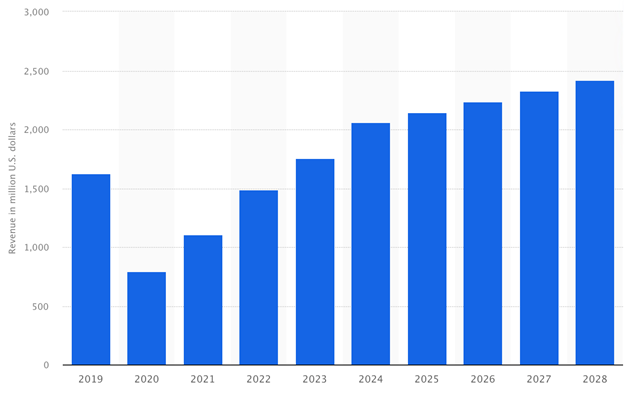

Revenue of the Hotels Market in the Philippines (2019 – 2028)

Source: Statista

Second, we can observe how the anticipated influx of visitors is expected to impact the hotel industry’s bottom line in the coming years. From a disappointing low of approximately $800 million during the pandemic in 2020, the industry’s total revenue is projected to grow 3x to about $2.4 billion by 2028, representing a compound annual growth rate (CAGR) of 14.72%. Additionally, this year’s total hotel revenue is expected to exceed $2 billion for the first time.

This exceptional growth trajectory underscores the lucrative investment opportunity in Manila’s hotel industry moving forward. The forecasted 300% revenue increase over just eight years also affirms the increasingly positive sentiment among industry experts regarding the country’s geopolitical and macroeconomic environment.

3. Vacation Rentals Revenue

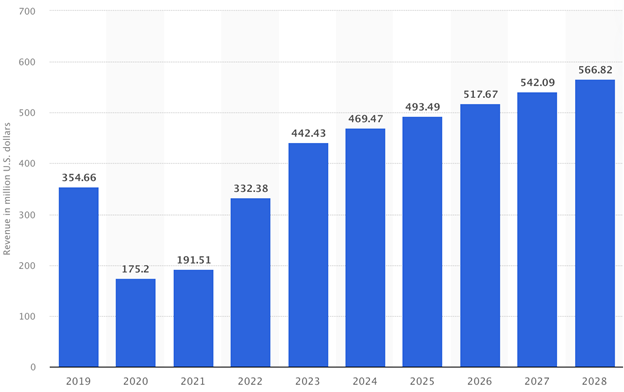

Revenue of the Vacation Rentals Market in the Philippines (2019 – 2028)

Source: Statista

Third, the vacation rental market, one of the fastest-growing segments in the hospitality sector, is expected to experience exponential growth in the coming years. From a recorded revenue of $175.2 million in 2020, the segment is projected to increase by 324% to approximately $566.82 million by 2028. This represents a CAGR of 15.81%, 109 basis points higher than the overall hotel market.

This indicates that new and upcoming real estate ventures and investment funds have room to grow to capitalize on this attractive prospect. Moreover, this additional growth, represented by the 109 basis points over the hotel market’s average, can be attributed to the anticipated increase in visitor numbers as well as rising local consumer spending on hotels and restaurants, which we will touch on next.

4. Consumer Spending

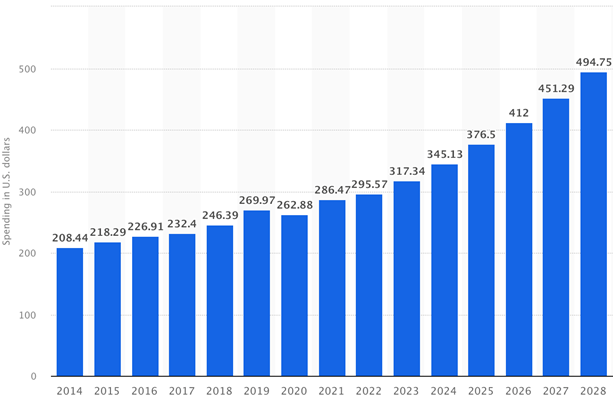

Per Capita Consumer Spending on Hotels and Restaurants in the Philippines (2014 – 2029)

Source: Statista

Fourth, the hospitality sector does not rely solely on the influx of visitors and foreign spending either. As we can see, local consumer spending per person in hotels and restaurants has significantly increased over the past 15 years, with only a slight dip during the pandemic in 2020. Considering the per capita growth starting in 2020, industry experts expect an 88.20% increase over the next eight years. This corresponds to a CAGR of 8.23%, which is above the average inflation rate in the Philippines — approximately 3% during the same period.

Thus, we can observe that discretionary spending by Filipinos on these leisure activities is increasing. This growth is primarily attributed to rising purchasing power, driven by Manila’s rising GDP per capita, which has grown from below $1,000 per Filipino in 2000 to US$ 3,700 by 2023. This further boosts the revenue potential of the hotel industry moving forward.

5. Market Penetration Rate

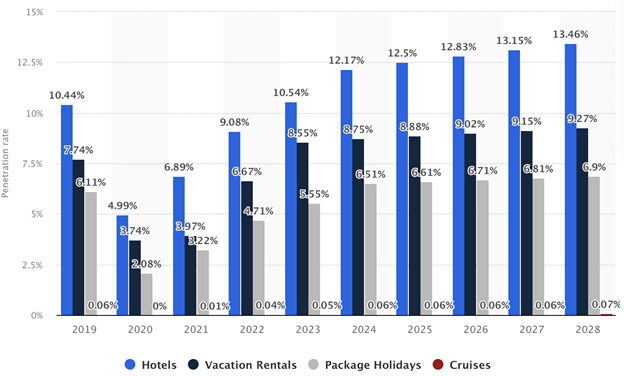

Penetration Rate in the Travel and Tourism Market in the Philippines (2019 – 2028)

Source: Statista

Lastly, to tie everything together, we observe that despite the promising future of the hospitality sector, the penetration rate remains relatively low. This indicates that hotels and vacation rental properties have significant room for growth, not only in the coming years but also in the decades ahead. As of 2023, the penetration rates for hotels and vacation rentals stand at 10.54% and 8.55%, respectively. Yet, in the same year, these hospitality segments registered double-digit growth rates of 16% and 33%, respectively.

Thus, property investment funds striving to capitalize on this upside potential can be rewarded with a lucrative long-term sustained profitability. This is considering the anticipated rapid increase in tourism influx in the coming years, the forecasted exponential growth in per capita spending by Filipinos, and the anticipation of the Philippines becoming an upper-middle-income economy as early as 2025.

Conclusion

With all these factors considered, the hospitality sector is poised to immensely benefit from the general upward trajectory of the Philippine economy. Furthermore, the remarkable developments in tourism numbers, along with the growth in market share of hotels and vacation rentals, and, of course, the rising per capita consumer spending of Filipinos, testify to the attractive prospects of the country’s hospitality sector.