In the bustling heart of Southeast Asia, the Philippines emerges as an exciting hub for real estate investors worldwide. This appeal is due not only to its stunning landscapes and rich cultural heritage—which many come to experience and love—but also to its attractive demographic trends, robust economic growth, and conducive environment for foreign investments. In this article, we will explore crucial aspects of Manila’s economic landscape and the opportunities in its real estate sector.

The Philippine Economic Miracle: Becoming The Rising Tiger of Asia

From the 1970s to the 1990s, the Philippines was dubbed ‘The Sick Man of Asia’ due to its poor economic performance, political instability, and lackluster investment opportunities. During the same period, its neighbors—Singapore, Taiwan, South Korea, and Japan—experienced massive economic growth, which boosted their standard of living and propelled these countries to become the region’s economic powerhouses.

Nevertheless, due to noteworthy economic and fiscal reforms in the Philippines, along with thriving foreign investments, the country registered an impressive average year-on-year (YoY) economic growth of 6-7% over the past decade prior to the COVID-19 pandemic, earning the coveted title of ‘The Rising Tiger of Asia.’ Furthermore, after making a significant economic recovery post-pandemic, the Philippines overtook Vietnam and Malaysia in 2023 to become the fastest-growing economy among the major Asian countries.

Factors Contributing to the Philippines’ Attractiveness

The following are the key elements contributing to the country’s attractiveness as a foreign investment hub:

1. Demographics

With the world’s 13th-largest population, the Philippines also has one of the youngest median ages (25 years old) in the Asia Pacific region. The growing young population is poised to fuel the country’s rapid economic growth, a distinguishing competitive advantage in the region.

2. GDP Growth

The Philippine government projects that the country’s GDP will grow by an additional 6.5% to 7.5% in 2024, representing one of the world’s highest economic forecasts. Meanwhile, S&P Global projects that the Philippine economy will be worth $1 trillion by 2033, more than doubling the 2023 GDP value, which is roughly $480 billion, in just nine years.

3. GDP Per Capita

The average yearly GDP per capita has increased dramatically over the past two decades, from below US$ 1,000 per Filipino in 2000 to US$ 3,700 by 2023. This represents a stronger purchasing and investing power of individuals in the country.

4. Foreign Direct Investments

In 2023, the country’s net foreign direct investments (FDI) stood at approximately $8 billion, marking one of the highest FDIs in recent years. Additionally, the government secured over $7 billion in investment pledges—representing an increase of over 127% from the previous year—credited to the recent foreign trips made by top Philippine officials.

5. Proactive Fiscal Policies

Lastly, the Philippine government is making remarkable efforts to bolster the country’s economic landscape further. These fiscal policies include enhancing international economic ties, investing at least 5% of its GDP in infrastructure projects annually, and strengthening its agricultural competitiveness in the region. Furthermore, the country registered a 110% increase in tourism from 2022 to 2023 and is aiming for another triple-digit growth in 2024.

These five key factors contribute to the country’s appealing value proposition and serve as the backbone of its economic miracle and growth story.

Philippine Stock Market

Now, let’s take a look at the Philippine Stock Market to see how these positive economic indicators translate:

Philippine Stock Exchange Index (PSEi) Chart

(November 1 – February 22)

As we can see, the country’s equities market has been rallying since November of last year. Currently, the PSEi—which represents the country’s 30 biggest publicly-listed companies—is up by 5.58% for the last month alone, 6.47% since the start of the year (YTD), and 10.37% over the past three months. This performance reflects both foreign and domestic investor confidence as well as the bullish sentiment regarding the country’s economic landscape and future outlook.

Why Invest in the Philippine Real Estate Market?

One of the major beneficiaries of the country’s economic growth is the property sector. On the fiscal side, this is attributable to the government’s commitment to improving the infrastructure system and effort to rapidly increase tourism, both of which have a carry-over effect on the real estate market by improving the value of existing as well as future property projects, particularly in the Metro Manila region (Manila, BGC, and Makati).

Furthermore, this upcoming further urbanization will drive demand in the business sector, particularly for building additional business establishments, office and co-working spaces, and housing. Not to mention the increase in rental yield from the projected tourism influx and the country becoming one of the rising preferred retirement destinations in the world.

On the socio-economic side, the economic prosperity of Filipinos, which has grown by 370% in 23 years, has translated to higher purchasing power and the ability to participate directly and indirectly in the real estate market. Moreover, the country’s outlook of more than doubling its economy in the next nine years speaks tremendously about the transformative potential of the real estate sector to not only support this exceptional advancement but also thrive by being one of the leading sectors to benefit from.

With these said, let us take a look at some noteworthy developments and trends in the real estate sector in the Philippines:

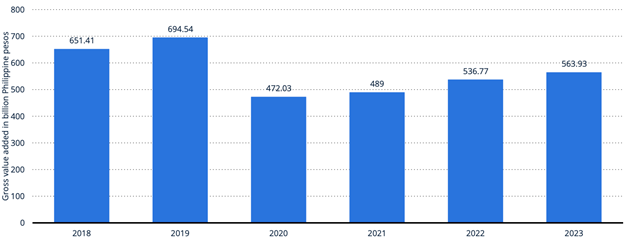

Gross Value Added Generated from the Real Estate Industry (2018 – 2023)

Source: Statista

First, examining the value added by the real estate industry in the Philippines, we observe significant contributions to the national economy. The industry has shown continuous growth following a substantial decline during the pandemic. From 2020 to 2021, the sector’s contribution increased by 3.6%, then surged by 8.9% from 2021 to 2022, and grew 5% further from 2022 to 2023.

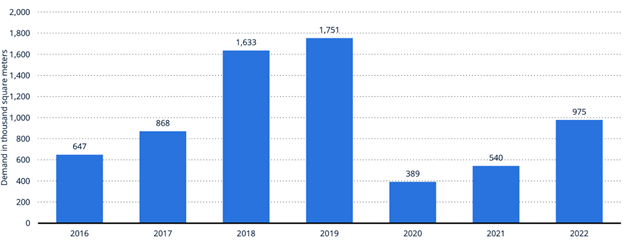

Office Space Demand in the Philippines (2016 – 2022)

Source: Statista

Second, zooming in on the most recent data on office space demand, we can observe a dramatic fall during the pandemic, coinciding with the nationwide lockdown enforced in the country. Subsequently, there was an outstanding improvement. From 2020 to 2021, the demand for office space rose by 39% and then by 81% during 2021-2022. This upward trend is expected to persist and accelerate in the following years.

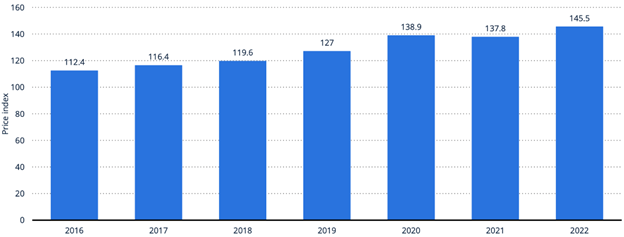

Residential Real Estate Price Index in the Philippines (2016 – 2022)

Source: Statista

Lastly, and perhaps the most remarkable, residential real estate has steadily increased in value even during the pandemic. This demonstrates the resilience of the residential real estate sector and the confidence among homeowners. Similarly, due to infrastructure development and urbanization (particularly in Metro Manila), this trend is also expected to accelerate in the following years.

Conclusion

With all these considered, the Philippine real estate market offers a compelling investment prospect backed by robust economic fundamentals, a supportive fiscal framework, and a young, growing population. These factors position the country as one of Asia’s most attractive real estate investment locations and prospective economic powerhouse. Hence, it may come as no surprise that the World Bank sees Manila becoming an upper-middle-income economy as soon as 2025.